Cushman & Wakefield today announced that it has been appointed as the marketing agent for the sale of a seven-storey freehold commercial building, known as Merchants Building, at No. 76 South Bridge Road.

The seven-storey freehold commercial building has a land area of 104.5 sq m (1,125 sq ft approximately). Under the Master Plan 2014, it is zoned “Commercial” with a gross plot ratio of 4.2.

Table of Contents

The seven-storey freehold commercial building is located on an envelope control site, within the secondary settlement of “Upper Circular Conservation Area” in the Central Business District (CBD). The gross floor area of the seven-storey freehold commercial building is estimated to be about 6,927 sq ft approximately.

The strata-titled units within the seven-storey freehold commercial building are currently being held by 6 separate ownerships and the owners have decided to jointly put up for sale by tender with a minimum reserve price of $23.5 million. Based on this reserve price, it would translate to about $3,392 psf on the gross floor area.

According to Mr Shaun Poh, Executive Director of Capital Markets at Cushman & Wakefield, “This sale represents an exquisite opportunity to acquire a freehold commercial building within the bustling city centre, which is a short 5-minute walk to the Clarke Quay MRT station (North-East Line). The vibrant precinct is a popular district for businesses, tourists and locals alike for its wide array of amenities.”

“Given the recent cooling measures in the residential segment, coupled with the optimistic outlook in the office sector, commercial properties especially those in prime central locations, such as Merchants Building, will likely interest opportunistic funds and investors looking for investment-grade assets. The Property would also be an excellent option for end-users such as design houses, professional service providers, co-working operators, family offices, amongst others, who are seeking to acquire an entire building to house their operations and enjoy naming rights on the building. The new owner will have the option to redevelop or enhance the asset through Addition and Alterations (A&A) works, subject to approval from relevant authorities.”

The tender for the seven-storey freehold commercial building will close at 3.00 pm on 5 December 2018.

Mr Paul Ho, chief mortgage consultant of iCompareLoan said owners of the seven-storey freehold commercial building going en bloc have to act quickly and decisively.

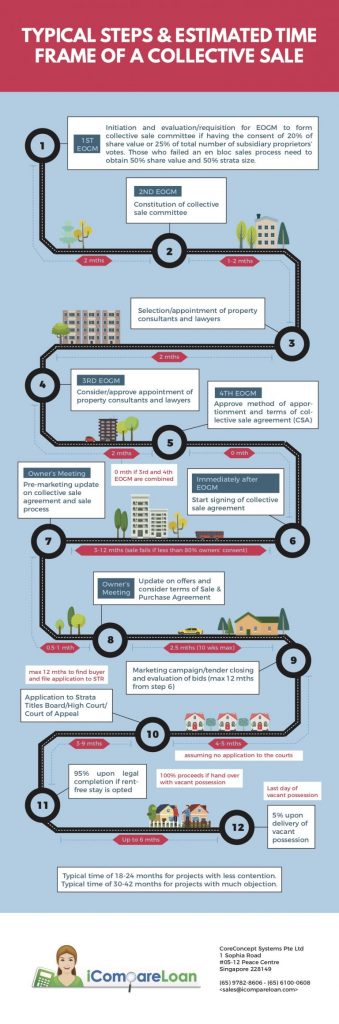

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

With the winding down of the success of residential en bloc sales, commercial properties are now trying to join in the bandwagon. Many commercial en bloc sale attempts fail because the asking prices are often too high. Two critical factors affecting the success of commercial sites going en bloc are pricing and location. Older commercial buildings especially, may see a need to catch the current wave as an exit strategy as their rental yields come under pressure due to competition from newer commercial buildings.

And whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new property early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Collective sale rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

How to Secure the Best Commercial Loans Quickly

iCompareLoan is the best infomercial loans portal for commercial-property-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s the most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is a Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse home loan packages for their clients and give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!