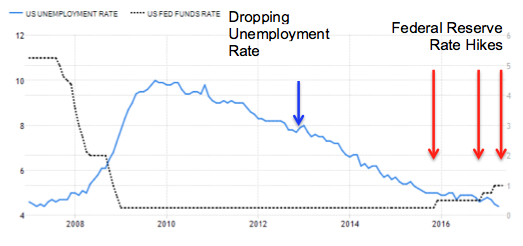

The Federal Reserve will meet again on the 13-14th June 2017. The latest May 2017 labour statistics show unemployment at 4.4%. This is the lowest ever since 2008.

Chart 1: US Unemployment Rate versus US Fed Funds Rate, Trading Economics

Although labour participation hardly moved at around 62.9% (and it still not back to its previous high) and core inflation has dropped from 2.4% to 2.2% in May 2017. The Federal reserve targets the Core Personal Consumption Expenditure inflation at 2%, Core CPE inflation above 2% is considered as a sign of overheating. A drop in inflation reduces the chances of a rate hike slight.

Note: The Core Inflation includes food and energy prices while Core PCE excludes Food and Energy prices and Core PCE is slightly lower than Core inflation at this point in time.

Many major media sites have started to talk about the possibility of rate hike.

According to CMEGroup, they derived algorithm that calculates the probability of rate hike based on asset prices. The probability of a rate hike now stands at 83.1% (27th May 2017). The asset prices are a collective wisdom of how the market sees the possibility of rate hike as people will either sell or buy stocks, bonds, assets depending what the rate hike means for them.

Chart 2: USD to SGD Chart (from May 2012 to May 2017), XE

There was a strengthening of the USD versus Singapore dollar when Trump was elected as people expected a stronger USD. Expected inflationary effects would also cause raising interest rate expectation.

However some of Trump’s policies will take time to materialise, hence that was probably the reason a stronger USD did not materialise versus the Singapore dollar and the USD started to weaken against the SGD.

If the June rate hike materialises, then it will be good to observe if the USD starts to strengthen against the SGD.

Federal Reserve Rate Hike – Should I Refinance to Fixed Rate home loan?

Table of Contents

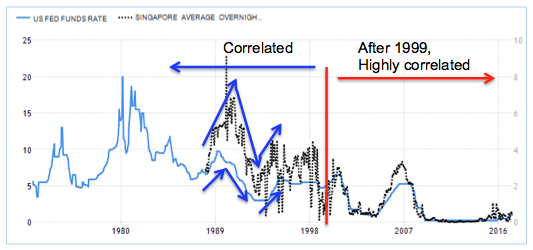

As globalisation forces countries to be more and more in lock step with each other, especially the relationship between the Federal Reserve Funds rate and that of Sibor. Take a look at this chart, you will see that Federal reserve overnight target funds rate are scarily correlated with Sibor, despite the interest rate differences. The pattern is similar.

For those who are unfamiliar can read more about what is Sibor or SOR.

Chart 3: Federal Reserve Overnight target rate versus Sibor overnight rate, Trading economics, iCompareLoan.com

US Fed funds rate (refer to left-hand-side vertical axis for the scale of the rates) and Singapore Average Overnight rate (refer to the right-hand-side vertical axis for the scale of the rates)

The chart traces back to 1988 when Sibor was tracked, a full 29 years of Sibor history and it’s correlation to the Fed funds rate.

If the Federal Reserve Open Market Committee meets on 13th and 14th June 2017 and decides to raise interest rates, there is a high chance that Sibor will follow suit to rise or it could rise in anticipation closer to the date.

When the rate hikes and Sibor rises, Singapore banks will start to adjust their fixed rate home loan packages as their cost of funds rises.

For those who believe that rates will hike a few more times in the coming 1 to 3 years, then the opportunity to refinance home loan to a fixed rate package is fast closing.

New Launch BUC condominium – What home loan packages to choose?

If you are buying a new launch condominium that is uncompleted, generally referred to as building-under-construction (BUC), fixed rate home loans are not available for BUC, but you can consider refinancing to packages that are pegged to fixed deposit.

DBS FHR (Fixed home rate) – This is a pegged to fixed deposit rates. UOB FDMR, OCBC FDMR, Standard Chartered FDMR, Maybank FDMR, these are all Mortgage Rate that are pegged to fixed deposit rates.

Fixed deposit rates tend to react more slowly to Sibor rate hikes and movements and although there is not much data to know how they will react in the future, people generally believe these type of packages will have some protection against rate hike. Read more about the Fixed Deposit Pegged Mortgage Rates.

For people who are buying a completed property project, they can consider locking into a fixed rate package.

We cannot be right all the time, because many political events or economic events can still change the trajectory of the charts. Just take your own precautions based on your family’s financial situation.

You can get in touch with a Mortgage Broker to discuss your property buying financing options.