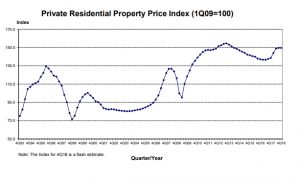

Private home price rose almost 8 percent in 2018 said the Urban Redevelopment Authority (URA) released flash estimate. The URA flas estmate of the price index for private residential property for 4th Quarter 2018 released today said overall, the private residential property index decreased by 0.1 point from 149.7 points in 3rd Quarter 2018 to 149.6 points in 4th Quarter 2018.

It added that this represents a decrease of 0.1%, compared to the 0.5% increase in the previous quarter. URA reminded that the Index for 4th Quarter 2018 is a flash estimate. Core Central Region in the flash estimate comprises Postal Districts 9, 10, 11, Downtown Core Planning Area and Sentosa. Rest of Central Region comprises the area within Central Region that is outside postal districts 9, 10, 11, Downtown Core Planning Area and Sentosa.

For the whole of 2018, private home price increased by 7.9%, compared with the 1.1% increase in 2017.

Table of Contents

Private home price of non-landed private residential properties decreased by 1.5% in Core Central Region (CCR), compared to the 1.3% increase in the previous quarter. Prices in the Rest of Central Region (RCR) increased by 1.8%, after registering a decrease of 1.3% in the previous quarter.

Private home price in Outside Central Region (OCR) increased by 0.8%, after registering a 0.1% decrease in the previous quarter. For the whole of 2018, private home price in CCR, RCR and OCR have increased by 6.2%, 7.4% and 9.5% respectively.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-December. The private home price statistics will be updated on 25 January 2019 when URA releases its full set of real estate statistics for 4th Quarter 2018. Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. The public is advised to interpret the flash estimates with caution.

Commenting on the 4th Quarter 2018 flash estimates Ms Tricia Song, Colliers International’s Head of Research for Singapore said:

“After five quarters of growth, overall private home prices fell marginally by 0.1% quarter-on-quarter (QOQ) in Q4 2018, as the cooling measures implemented in July continued to depress home values. This is the first quarterly decline since Q2 2017 where home prices dipped by 0.1% QOQ from Q1 2017. Based on caveats downloaded, overall transactions (excluding ECs) in Q4 2018 fell 36% QOQ to 3,515 units.

For the whole of 2018, private home prices rose by 7.9% – with most of the increase achieved in the first half of the year – in line with Colliers’ expectation of an 8% growth for the year.

The price decline in Q4 2018 was led by the Landed Property and Core Central Region (Non-Landed) segments where values fell by 1.8% and 1.5% respectively. We believe the drop in Landed Home prices could be due to the higher base in Q3, during which landed home price index climbed 2.3% QOQ, compared to the flat growth in non-landed homes then. During Q4 2018, Belgravia Green was the top seller and the only major landed property launch with 34 homes sold at a median price of SGD862 psf per strata area. Median price quantum per landed home has remained relatively stable at SGD2.8-3.0 million since Q1 2015.

Core Central Region (CCR)

Prices of non-landed private residential properties declined by 1.5% in the CCR, compared to the 1.3% increase in the previous quarter. The decline could be attributed to a higher base set in preceding quarters and the slower transactions as investors paused to contemplate the incremental taxes.

We note that prices at the new launches are still holding up — 3 Cuscaden and 10 Evelyn were the only new CCR launches in Q4. 3 Cuscaden sold 24 units at a median price of SGD3,545 psf while 10 Evelyn sold two units at a median price of SGD2,478 psf. For projects that were launched earlier – 120 Grange sold another two units at a median price of SGD3,318 psf, 8 Saint Thomas sold 19 units at a median price of SGD3,254 psf, while New Futura (which was launched in Q1 2018 and has seen stellar takeup since) still achieved an average price of SGD3,757 psf compared to an average of SGD3,436 psf recorded in the first three quarters of 2018.

With more and larger projects to be launched in 2019, we expect exciting concepts and potentially benchmark pricing in localities that have not seen major launches for an extended period of time.

Rest of Central Region (RCR)

In contrast, prices in the RCR strengthened by 1.8%, after posting a decrease of 1.3% in the previous quarter. Projects that were launched in November contributed to the price growth in Q4. These were Arena Residences, Kent Ridge Hill Residences, Parc Esta and The Woodleigh Residences. These launches achieved good takeup rates at median prices of SGD1,820, SGD1,714, SGD1,699 and SGD2,002 psf in Q4 2018 respectively.

In 2019, we expect RCR to see fewer launches than in 2018, with key ones such as the 1,101-unit Silat Avenue, redevelopment of Pearl Bank Apartments, and Normanton Park. Prices are expected to be relatively stable given the steady sales clocked at the 2018 launches such as Park Colonial, Stirling Residences and Parc Esta but which still have significant stock to sell.

Outside Central Region (OCR)

Meanwhile, home values in the OCR climbed by 0.8% in Q4, following a 0.1% decrease in the Q3 2018. Prices were held up by large launches that have been put on the market in Q4 2018 and earlier. The key contributing projects were: Affinity at Serangoon, Riverfront Residences, Le Quest and The Jovell which saw stable to marginally improved median prices of SGD1,498, SGD1,320, SGD1,426 and SGD1,335 psf respectively.

In 2019, we expect several large launches such as the 2,225-unit Treasure at Tampines and 1,410-unit The Florence Residences in the OCR. Given the sheer size of the projects and potential competition, we expect them to be priced competitively and still offer compelling themes. We expect OCR to see some pricing pressure through 2019.”

Colliers estimates that overall private home price could potentially climb by 3% in 2019, in line with the economic growth – barring any unforeseen events.

“Supply side factors will be supportive of prices given: a) the completions for the next few years will be below historical average; b) the land rates at which the developers have acquired sites via the collective sales and public land tenders are indicative of at least the current market prices; and c) developers are unlikely to cut prices unless they are under extenuating circumstances.

Meanwhile, demand side factors such as household income growth, job security, household formations are likely to be positive for private housing. That said, one key area to watch this year is the pace of interest rate hikes which will likely weigh on home buying interest should they escalate sharply.

For the end-buyers, we think it is conceivable that the market sentiment will likely maintain status quo in the first half of 2019 as the property curbs continue to moderate investment demand for private homes. Barring external shocks – such as the worsening of the US-China trade spat, messy Brexit, and heightened geopolitical tension – the Singapore economy is expected to chug along steadily in 2019, and this should still drive owner-occupier and upgraders’ demand, who are less or not affected by the curbs.

For the developers, given the sizable supply pipeline from public land tenders and private collective sale sites accumulated before the curbs, they are likely to be more cautious and may pace out their launches to ensure the market remains sustainable in 2019. By the middle of this year, with the relatively healthy takeup since the curbs, and assuming a benign economic outlook, developers could be more active in landbanking again.”

How to Secure a Home Loan Quickly

Are you planning to buy a new private home but are concerned about private home price? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner. We are the experts who do the work for you for free, while you lean back, rest and rely on our professionalism at absolutely no cost to you.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.