The Urban Redevelopment Authority (URA) real estate statistics for 3rd Quarter 2019 released today shows that the private housing prices have resumed their growth trajectory.

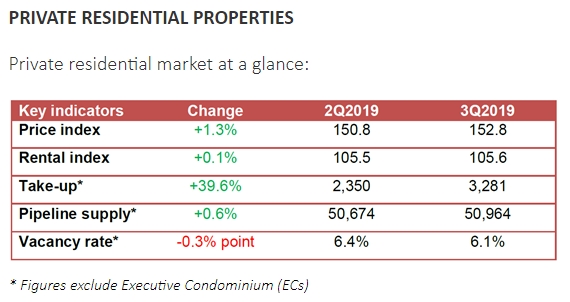

Private housing prices increased by 1.3% in 3rd Quarter 2019, compared with the 1.5% increase in the previous quarter.

Prices of landed properties increased by 1.0% in 3rd Quarter 2019, compared with the 0.1% decrease in the previous quarter. Prices of non-landed properties increased by 1.3% in 3rd Quarter 2019, compared with the 2.0% increase in the previous quarter.

Prices of non-landed properties in Core Central Region (CCR) increased by 2.0% in 3rd Quarter 2019, compared with the 2.3% increase in the previous quarter. Prices of non-landed properties in Rest of Central Region (RCR) increased by 1.3%, compared with the 3.5% increase in the previous quarter. Prices of non-landed properties in Outside Central Region (OCR) increased by 0.8%, compared with the 0.4% increase in the previous quarter.

Rentals of private residential properties increased by 0.1% in 3rd Quarter 2019, compared with the 1.3% increase in the previous quarter.

Rentals of landed properties decreased by 2.3% in 3rd Quarter 2019, compared with the 0.3% increase in the previous quarter. Rentals of non-landed properties increased by 0.4%, compared with the 1.4% increase in the previous quarter.

Rentals of non-landed properties in CCR decreased by 0.7%, compared with the 1.5% increase in the previous quarter. Rentals in RCR increased by 1.6%, compared with the 1.4% increase in the previous quarter. Rentals in OCR increased by 0.8%, compared with the 1.2% increase in the previous quarter.

Launches and Take-up

Developers launched 3,628 uncompleted private residential units (excluding ECs) for sale in 3rd Quarter 2019, compared with 2,502 units in the previous quarter. Developers sold 3,281 private residential units (excluding ECs) in 3rd Quarter 2019, compared with the 2,350 units sold in the previous quarter. Developers launched 820 EC units for sale in 3rd Quarter 2019. 426 EC units were sold in the quarter. In comparison, developers did not launch any EC units and sold 10 EC units in the previous quarter.

Resales and Sub-sales

There were 2,378 resale transactions in 3rd Quarter 2019, compared with the 2,371 units transacted in the previous quarter. Resale transactions accounted for 41.3% of all sale transactions in 3rd Quarter 2019, compared with 49.7% in the previous quarter.

There were 104 sub-sale transactions in 3rd Quarter 2019, compared with the 45 units transacted in the previous quarter. Sub-sales accounted for 1.8% of all sale transactions in 3rd Quarter 2019, compared with 0.9% in the previous quarter.

Supply in the Pipeline

As at the end of 3rd Quarter 2019, there was a total supply of 50,964 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with the 50,674 units in the previous quarter. Of this number, 31,948 units remained unsold as at the end of 3rd Quarter 2019, compared with the 33,673 units in the previous quarter. After adding the supply of 3,722 EC units in the pipeline, there were 54,686 units in the pipeline with planning approvals. Of the EC units in the pipeline, 2,141 units remained unsold. In total, 34,089 units with planning approvals (including ECs) remained unsold, down from 35,538 units in the previous quarter. Based on the expected completion dates reported by developers, 3,235 units (including ECs) will be completed in the last quarter of 2019. Another 5,750 units (including ECs) will be completed in 2020.

Apart from the 34,089 unsold units (including ECs) with planning approval as at the end of 3rd Quarter 2019, there is a potential supply of 4,900 units (including ECs) from Government Land Sales (GLS) sites and awarded en-bloc sale sites that have not been granted planning approval yet. These comprise (a) about 4,400 units from awarded GLS sites and Confirmed List sites that have not been awarded yet, and (b) about 500 units from transacted en-bloc sale sites.

Stock and Vacancy

The stock of completed private residential units (excluding ECs) increased by 278 units in 3rd Quarter 2019, compared with the increase of 863 units in the previous quarter. The stock of occupied private residential units (excluding ECs) increased by 1,095 units in 3rd Quarter 2019, compared with the increase of 584 units in the previous quarter. As a result, the vacancy rate of completed private residential units (excluding ECs) decreased to 6.1% as at the end of 3rd Quarter 2019, from 6.4% in the previous quarter. Vacancy rates of completed private residential properties as at the end of 3rd Quarter 2019 in CCR, RCR and OCR were 8.2%, 6.0% and 5.3% respectively, compared with the 7.8%, 6.4% and 5.7% in the previous quarter.

“Despite the cooling measures in July 2018, private housing prices have resumed a growth trajectory after falling just 0.7% over two quarters in Q4 2018 and Q1 2019.”

Commenting on the private housing prices upward trajectory, Colliers International said:

“Despite the cooling measures in July 2018, private home prices have resumed a growth trajectory after falling just 0.7% over two quarters in Q4 2018 and Q1 2019, outperforming most market expectations. We believe the resilience was due to: 1) a pent-up demand from improving household wealth and income amidst below-average developer takeup over 2014-2018; 2) availability of attractive launches since 2018; and 3) the latest measures were incrementally less punitive on end-buyers than earlier measures in 2013. We also note there were more foreigners buying luxury properties in the recent few quarters, possibly attracted by the stability and safety attributes of Singapore properties amidst global volatility.

Nonetheless, the pace of price increase has slowed, and coupled with a slower economic growth outlook, we do not expect the government to impose more cooling measures at this stage.”

Ms Tricia Song, Colliers International’s Head of Research for Singapore, said, going by the recent launches, she expects prices to be flat or see a marginal improvement in Q4 2019, which could bring the full year 2019 price increase to 2.5%.

“We remain watchful of global risks and macroeconomic headwinds which could weigh on the residential property sector.

Broadly, there is still an ample launch pipeline which should keep prices stable. Potential launches include prime projects in CCR: Pullman Residences (340 units, former Dunearn Gardens), Hylle on Holland (321 units, former Hollandia and The Estoril), One Holland Village (559 units), former Tulip Garden (672 units), Midtown Bay (219 units), former Pacific Mansion (376 units) etc.

In the city fringe, launches include: Verdale (258 units) and Amber Sea (132 units). Meanwhile, in the suburbs, potential launches include: Sengkang Grand Residences (682 units), Infini at East Coast (36 units), and Midwood (564 units).”