The Urban Redevelopment Authority’s (URA) flash estimates of the 3rd Quarter 2018 private residential property price index released on Oct 1 showed that Singapore properties were still shining bright said List Sotheby’s International Realty, Singapore (Sotheby’s).

Overall, the private residential property price index increased 0.7 points from 149.0 points in 2nd Quarter 2018 to 149.7 points in 3rd Quarter 2018. This represents an increase of 0.5 per cent, compared to the 3.4 per cent increase in the previous quarter.

Prices of non-landed private residential properties increased by 1.2 per cent in Core Central Region (CCR), compared to the 0.9 per cent increase in the previous quarter. Prices in the Rest of Central Region (RCR) decreased by 0.8 per cent, after registering an increase of 5.6 per cent in the previous quarter. Prices in Outside Central Region (OCR) increased by 0.1 per cent, after registering a 3.0 per cent increase in the previous quarter.

URA’s flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-September. The statistics will be updated on 26 October 2018 when URA releases its full set of real estate statistics for 3rd Quarter 2018. Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. URA advised the public to interpret the property price index flash estimates with caution.

Sotheby’s said that the increase of 0.5 per cent in the overall private residential property index shows that the market is resilient and that there is sufficient appetite from serious buyers who are likely to be first time buyers or Permanent Residents less affected by the cooling measures.

Sotheby’s said that the increase of 0.5 per cent in the overall private residential property index shows that the market is resilient and that there is sufficient appetite from serious buyers who are likely to be first time buyers or Permanent Residents less affected by the cooling measures.

“This is in line with the original intent of the measures, which was to achieve a more gradual, but sustainable, price appreciation in the longer term. For non-landed private residential properties, prices in the Core Central Region (CCR) had a better than expected showing, while prices in Outside of Central Region (OCR) registered a smaller increase than the previous quarter.”

Sotheby’s noted that the greatest impact was seen in the Rest of Central Region (RCR), where prices fell by 0.8 per cent, which is a large contrast to the increase of 5.6 per cent in the previous quarter.

Sotheby’s explained that the price fall for Singapore properties was due to the relatively lower price points of new projects launched in the third quarter.

Table of Contents

“Moving ahead, we expect demand to recover slowly and, with the looming supply in the near future, it will still be a buyers’ market out there. In terms of prices, it would seem that price appreciation will be at a slower pace,” Sotheby’s said in its analysis of Singapore properties. Adding: “Homeowners should take heart that the market is stable and that any price increase will be in tandem with the economic growth.”

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

Another report, the UBS Global Real Estate Bubble Index 2018 report, said Singapore is one of its study’s few cities whose housing affordability has improved over the past decade.

Its report on Singapore properties predicted:

“Additional buyer stamp duties (ABSD) have been targeted specifically at developers to limit land price speculation. Purchasers of investment properties have also been slapped with higher ABSD. So we expect speculative buying to decline and price growth to decelerate by the end of the year. Rising interest rates limit the upside as well. Overall, the consequent stalling of any price rebound by the government prevents the emergence of speculative tendencies in the real estate market.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

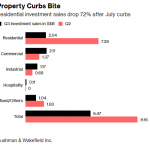

Commenting on the Q3 proeprty price index, JLL said that a trend of price moderation can be seen in 3Q18 due to the effects of the cooling measures that were imposed in early July.

JLL said that most prime district buyers of Singapore properties had to explore opportunities in the secondary market, which accounted for 76 per cent of CCR transactions in 3Q18 (based on caveats in URA Realis to-date), driving up secondary market median price from $1,838 psf in 2Q18 to $1,919 psf in the third quarter.

“The measures have arrested price increases in existing new projects, moderated new launch prices and tempered asking prices in the resale market as well,” JLL said. Adding: “We can expect this trend to continue with price increases remaining low key or flattening out in the next few quarters.”

CBRE earlier said that it maintains a 8-10 per cent overall increase for the property price index (PPI) in 2018, on the back of upcoming launches acquired at higher land costs. It added, “while prices in psf are expected to continue to drive the PPI, new sales have been driven by the total price quantum supported by smaller unit sizes.”

How to Secure a Home Loan Quickly

If you want to buy Singapore properties but are ensure of funds availability for purchase, our mortgage consultants at iCompareLoan can set you up on a path that can get you a home loan in a quick and seamless manner.

Our consultants have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.