Edmund Tie & Company (ET&Co), the sole marketing agent for the collective sale of Golden Mile Complex, on Jan 7 announced that the landmark commercial property is up for sale by tender. ET&Co informed that the Urban Redevelopment Authority (URA) has advised that a gross floor area (GFA) of 85,977.5 sq m can be considered. This is subject to the conservation of the main building of Golden Mile Complex.

Outline Application has been submitted to retain the existing 16-storey building and to add a new block next to the building. The planning advice from URA indicates that under the existing Commercial zone, the property may be developed as an integrated development comprising uses such as retail, office, residential, serviced apartments and hotels.

Golden Mile Complex has a land area of approximately 1.3 hectares and is zoned for Commercial use under Master Plan 2014.

Table of Contents

Golden Mile Complex is an iconic development occupying a prominent plot along Beach Road, boasting commanding dual frontage along Beach Road and Nicoll Highway with panoramic city and sea views. It is strategically positioned at the gateway to the city centre just outside the Electronic Road Pricing zone and just a stone’s throw away to Nicoll Highway MRT station on the Circle Line (CCL). Its signature step-terraced building design is a visionary architectural masterpiece and is Singapore’s icon of urbanism.

DP Architects (formerly known as Design Partnership), who designed Golden Mile Complex in the 1960s as one of the first Government Land Sale sites, is on board as Consultant Architect for the development as appointed by the Collective Sale Committee.

Chan Hui Min, director of DP Architects commented: “Golden Mile Complex is an architectural icon and many people think that it is important to the public memory of Singapore. It can be sensitively integrated into the new development and be adapted to new uses that meets the needs of today. Many successful developments that integrate older buildings not only manage to optimise the land use efficiency, but also leverage on the history of the site to bring value to the sense of place and identity of the development. We can create win-win situations with sensitive adaptive reuse.”

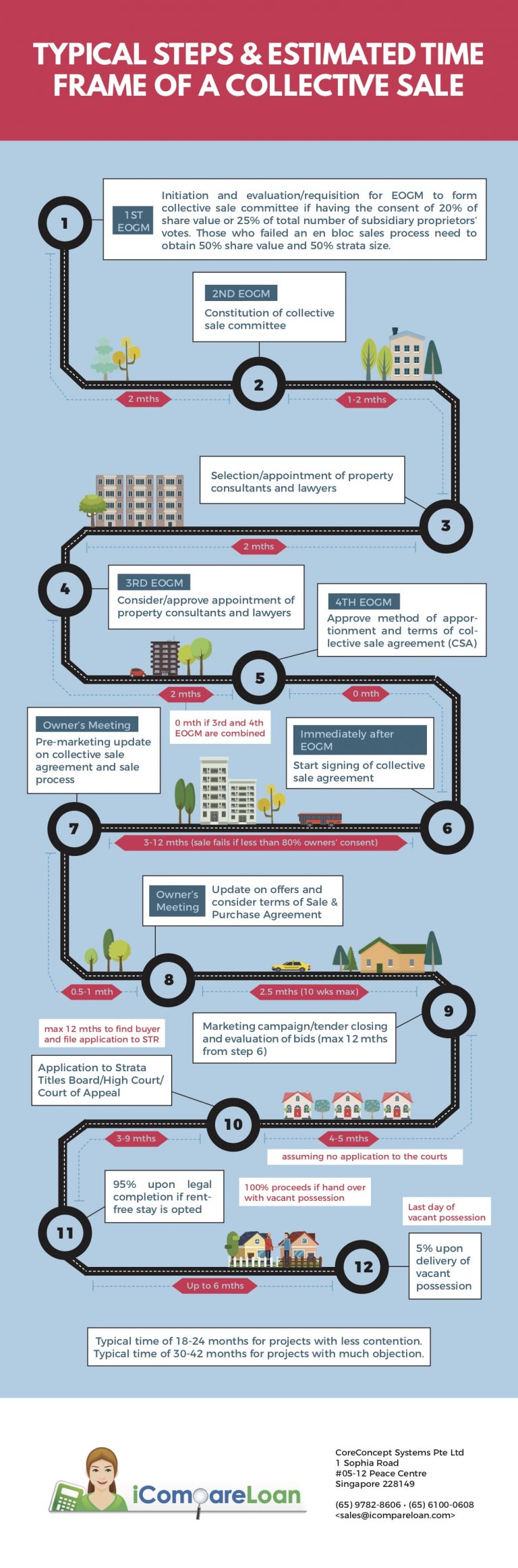

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

Located within the Beach Road/Ophir-Rochor Corridor which is envisioned to be a vibrant mixed-use cluster under Master Plan 2014, Golden Mile Complex presents an exceptional opportunity to create a landmark destination at Beach Road, integrating work, live, and play elements.

Senior director of investment advisory Swee Shou Fern commented: “Golden Mile Complex is a national icon that has shaped the visual character of our built landscape. We are proud to present this rare opportunity for adaptive reuse. Its distinctive architecture and worldwide iconic status will offer tremendous potential to transform the property into an exciting work-live-play destination in this growth area.

“The new Golden Mile Complex will be an essential part of the rejuvenation of the Beach Road corridor. This unique adaptive reuse opportunity provides the developer with the chance of incorporating a new vision into this iconic development. Many exciting development concepts may be considered for the property.

The reserve price for Golden Mile Complex is $800m.

The differential premium and lease upgrading premium to intensify the land use and to top up the lease to 99 years respectively will depend on the developer’s proposed land use mix.

The tender exercise for Golden Mile Complex will close on Wednesday, 30 January 2019 at 3pm.

With the winding down of the success of residential en bloc sales, commercial properties are trying to join in the bandwagon. But some analysts believe that “going for conservation status” may reduce the en bloc site’s sale value.

Savills Singapore senior director of research and consultancy Alan Cheong said in speaking to The Straits Times, “conservation complicates matters because the cost variables and net sellable area are now less certain. The developer has to find out what needs to be conserved and figure out the costs of building within the constraints.”

While International Property Advisor chief executive Ku Swee Yong said developers may try to press for a lower price to accommodate possible higher construction costs.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Mr Paul Ho, chief mortgage consultant at iCompareLoan said, “many commercial en bloc sale attempts fail because the asking prices are often too high.”

“Two critical factors affecting the success of commercial sites going en bloc are pricing and location – older commercial buildings especially, may see a need to catch the current wave as an exit strategy as their rental yields come under pressure due to competition from newer commercial buildings,” he added.

How to Secure a Commercial Loan Quickly

Are you planning to purchase a similar prime commercial redevelopment site but unsure of funding? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding on your purchase. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your commercial purchase needs. Our services are also very personalised and tailored to the unique needs of the buyers.

Whether you are looking for a new commercial loan or to refinance and existing one, our brokers can help you get everything right from calculating mortgage repayments, comparing interest rates, all through to securing the final loan. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us for your next purchase.

If you need advice on a new commercial loan or Personal Finance advice.

If you want to speak to our trusted Panel of Property agents.

If you need refinancing advice.