Singapore’s home loan interest rates are expected to be impacted by the Monetary Authority of Singapore’s (MAS) tightening of the Singapore Dollar (SGD) exchange rate. MAS announced a measured change to policy today, allowing its currency to strengthen in the face of solid economic growth. MAS, which is essentially Singapore’s Central Bank, uses the exchange rate to guide the SGD higher or lower. Its press release also acknowledged the mounting risks from a U.S.-China trade war.

In moving away from the easing stance adopted in recent years, MAS increased the slope of the currency band slightly from zero per cent. MAS which uses the exchange rate to manage inflation said that domestic sources of inflation are expected to rise gradually in 2018.

MAS noted that Consumer Price Index (CPI)-All Items inflation should increase in the quarters ahead, and is projected to be in the upper half of the 0–1% forecast range for 2018 as a whole. In Singapore, the most important categories in the consumer price index are housing (25 percent of total weight).

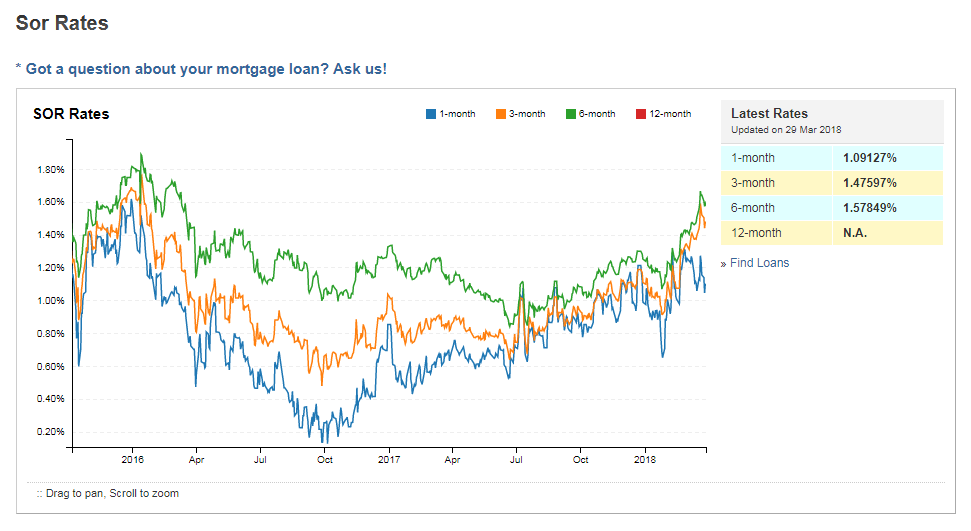

USD/SGD saw a knee jerk reaction at the press release by MAS. The currency pair plunged to a low of 1.3079 before quickly recovering to 1.3111. If the SGD continues to strengthen against the United States Dollar (USD) it will have an effect on home loan interest rates like the banks’ Swap Offer Rates (SOR), which tracks the expected forward exchange rate in the USD/SGD exchange rate.

If the SGD strengthens against the USD, there will be a downward pressure on SOR, decreasing its value. The opposite happens if the greenback strengthens against the SGD.

SOR is set by the Association of Banks in Singapore and comes in different blends of 1-, 3-, 6- , 12-month. Upon maturity of the SOR tenor, there is a Forex conversion from USD to SGD, but there is no bid and spread, therefore the banks save money among themselves. Also, as SOR can be interpreted as currency swaps between USD and SGD, it has slightly more volatility compared to Singapore Interbank Offered Rate (SIBOR).

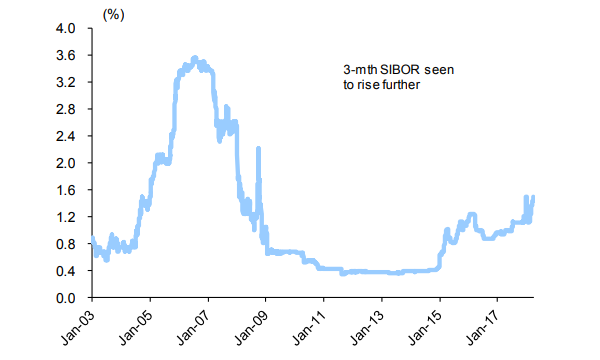

Not only the home loan interest rates tied to SOR witll rise, but also packages tied to SIBOR. RHB research released last week showed that the 3-month SIBOR grew to 1.51% from 1.37% at the beginning of March.

RHB analyst Leng Seng Choon noted that DBS increased its 3-month fixed deposit rates over the previous four weeks by 30bps to 0.9 per cent at end-March and UOB likewise by 17bps to 1.4 percent.

https://www.icompareloan.com/resources/fed-interest-rates-hike-impact-loans/

“Other banks have also raised their fixed deposit rates over the past month,” the analyst said, adding: “this would be positive overall for banks’ net interest margins (NIM).”

MAS’s tightening of the exchange rate today will introduce some short-term weakness in SIBOR, which could temporarily slow the trend of NIM widening for Singapore banks. RHB, however, believes that the longer term trend of NIM widening remains intact.

Considered over a longer period of time, home loan interest rates tied to both SIBOR and SOR tend to have similar mean (averages). But those with a greater risk appetite usually choose SOR, because SOR’s pricing is more correlated to the forward trend of the USD/SGD. But if they think that the USD will gradually appreciate against the Singapore dollar, they could consider taking the SIBOR.

—

If you are unsure about which home loan package would be the best fit for you, you should speak with a mortgage specialist at iCompareLoan. We can assist you for free in your choice of Loan packages with the best home loan interest rates.